3 mins mins

Key Points:

- Trump criticized Federal Reserve for slow rate cuts, affecting homebuyers.

- No official confirmation of new statements from Trump.

- Crypto market remains stable without major reaction to rumors.

On July 31st, former U.S. President Donald Trump allegedly criticized Federal Reserve Chair Jerome Powell, suggesting rate reductions to aid buyers, though no official statement was confirmed.

Such comments historically trigger volatility in cryptocurrencies like BTC and ETH, but market reactions remain muted without official confirmation from Trump or the Federal Reserve.

Trump’s Fed Critique Creates Market Ambiguity

Reports suggest Trump has criticized Powell for not cutting rates promptly. The remarks were made publicly, although no direct source confirms this explicitly from Trump’s verified channels. Powell’s actions are closely monitored, though direct actions are seldom linked to immediate changes in crypto markets.

Current economic conditions remain tumultuous due to rate policies. While Federal Reserve decisions typically affect digital assets like Bitcoin and Ethereum, these remarks failed to create immediate upheaval. Market activities signify stability in the absence of verified announcements, underscoring the weight tied to authenticated statements from high-profile leaders.

“As of July 30, 2025, there is no direct official statement on Trump’s verified Twitter/X account or his official website referencing a new statement about Powell or Federal Reserve rates on this date,” said Donald J. Trump, 45th President of the United States.

Industry reactions are muted due to the lack of verified information. Major accounts connected to cryptocurrency industry leaders and economic commentators have yet to provide any formal responses to Trump’s alleged critique. Official channels remain devoid of corresponding sentiment, maintaining the existing market equilibrium.

Cryptocurrency Stability Amidst Economic Policy Speculations

Did you know? During the 2019-2020 period, President Trump’s criticism of the Federal Reserve occasionally coincided with heightened volatility in risk assets, including cryptocurrency.

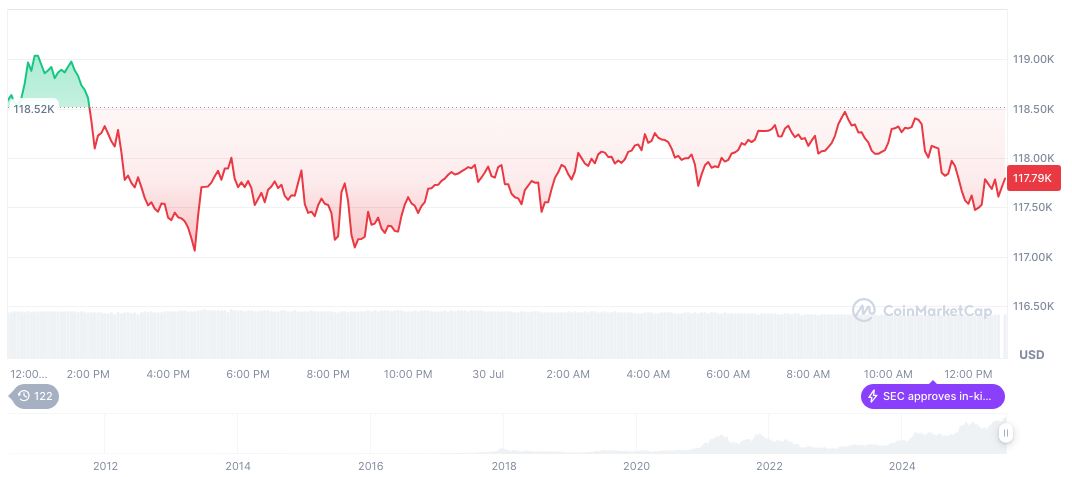

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $117,205.54, with a market cap of $2.33 trillion. Trading volume over the last 24 hours reached $68.78 billion, reflecting a 39.87% change. Bitcoin’s price has decreased by 0.47% in the last 24 hours but has seen a 21.08% increase over 90 days. These figures suggest stability amidst market speculation.

The Coincu research team highlights that financial markets remain sensitive to Federal Reserve policies. Should rate changes occur, potential impacts on cryptocurrencies include shifts in trading volume and price volatility. Historical data shows that crypto prices frequently react to macroeconomic cues, although no immediate changes are evident. However, closely tracking verified statements and financial announcements is critical for understanding future market behaviors.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Rate this post